200000 mortgage cost

Homeowners who put less than 20 down on a conventional loan also have to pay for property mortgage insurance until the loan balance falls below 80 of the homes valueThis insurance is rolled into the cost of the monthly home loan. Buying a home might be the easier option.

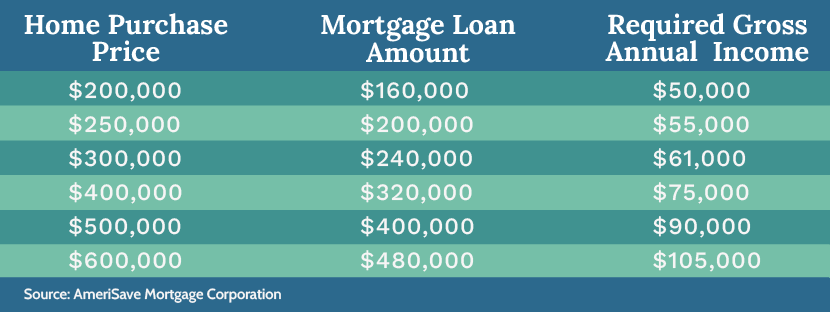

Income Requirements Calculator For A Home Mortgage Amerisave

The true cost of auto insurance in 2022.

. Costs per points Monthly payment Total savings on a 30-year loan. Browse Investopedias expert-written library to learn more. Thats because if the lease you are extending is the lease on your only main residential property youll be charged a rate of 0 stamp duty on the first 125000 of the cost of the extension.

179 1296751 129528. You have 40000 for a down payment so you need a 160000 loan to meet the 200000 purchase price. On average a tiny home costs less than one-fifth what a traditional home would cost.

Unlike other fees discount points arent mandatory. Check out our total breakdown to see if you can afford a custom home. Since private mortgage insurance PMI lowers this risk it allows people to buy homes with down payments smaller than the traditional 20.

5875 6018 113479. Planning for retirement helps you determine retirement income goals and prepare for the unexpected. The bank will base the loan amount on the 200000 figure because its the lower of the 2.

0 points 45 APR 0. Better Money Habits can help determine if buying discount points makes sense. If a problem arises the insurance covers the lenders investment in your mortgage.

For example if you take out a mortgage for 100000 one point will cost you 1000. What to know about mortgage prequalification 4 min read. Generally conventional lenders require homebuyers who put down less than 20 to purchase.

In contrast the average headline inflation rate over the same period was only 154. The home you want to buy has an appraised value of 205000 but 200000 is the purchase price. As a result payment amounts and the duration of the loan are fixed and the person who is responsible for paying back the loan benefits from a consistent single payment and the ability.

Learn more mortgage loan rates and see payment details. 15 Year Fixed Payment Details. The average cost of a built-to-suit tiny house is 59884.

For a 200000 loan a point costs 2000. So for example if the cost of extending your lease was 10000 youd pay nothing in stamp duty. If you put 10 percent down on a 200000 home for example youd have to take out a.

Or maybe youre wondering. Number of Payments Payment Amount. Conventional loans require private mortgage insurance if you make less than 20 down payment on the homes purchase price.

Cost range 700 to 900. Associated Bank offers a variety of mortgage products. The average sales price of a newly-built single-family home is 383900.

Home buyers who have a strong down payment are typically offered lower interest rates. Your monthly payment. Its important to understand what mortgage points are when seeking a loan.

Your up-front mortgage points cost. The average cost to build a house is about 290000. Your fees for any discount points will appear on your Loan Estimate under Origination Charges.

How much does it cost to open a pizza shop or start a deli Or how much it may cost to start a high-end restaurant with unique fare The answers to these questions vary. The average cost of a DIY home build is closer to 23000. A fixed-rate mortgage FRM is a mortgage loan where the interest rate on the note remains the same through the term of the loan as opposed to loans where the interest rate may adjust or float.

PMI is usually included into your monthly mortgage payments costing between 05 1 of your loan amount annually. And when we look at our own national data from 2001 to 2021 the cost of healthcare increased by 548 and the average healthcare inflation rate was 221. You multiply 80 by 100 and that gives you an LTV of 80.

This is an added cost that protects lenders in case borrowers default on their mortgage. Mortgage insurance is a type of insurance policy that protects the lender against default on home loans. The average listing price of a home on Zillow is 275000.

The average restaurant startup cost is 275000 or 3046 per seat for a leased building. It can also be easier to get a mortgage because you dont have to deal with finding a. The fees for the new loan are 2500 paid in cash at closing.

The example assumes a 200000 30-year fixed-rate mortgage at 5 and a current loan at 6. What Is Mortgage Insurance.

How Much Would I Pay On A 200 000 Mortgage Finder Canada

What Is The Monthly Payment On A 200 000 Mortgage

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

How Much A 200 000 Mortgage Will Cost You

5 Year Fixed Mortgage Rates And Loan Programs

How Much House Can I Afford Bhhs Fox Roach

How Much A 1 000 000 Mortgage Will Cost You Credible

How Much Would I Pay On A 200 000 Mortgage From 1 24

Article Real Estate Center

When Do Homeowners Pay More In Principal Than Interest 2021 Study

Mortgage Rates Roll Back To Yearly Low Mortgage Rates Mortgage Payment Pay Off Mortgage Early

How Much A 350 000 Mortgage Will Cost You Credible

Discount Points Calculator How To Calculate Mortgage Points

What A 200 000 Mortgage Will Cost You Credit Com

Bi Weekly Loan Calculator Biweekly Payment Savings Calculator

How Much Would My Payment Be On A 200 000 Mortgage Finder Com

How Much A 200 000 Mortgage Will Cost You